I just got back from Reno, Nevada. Some thoughts on my short vacation:

1. Not including the more isolated Peppermill and Atlantis hotels, the best downtown Reno buffet is El Dorado, especially if you have a sweet tooth. Their dessert options were incredible. Fruit tarts, cakes, little chocolate pies, flan, more tarts, and gelato.

2. When factoring cost, the best overall Reno restaurant is Harrah's Cafe Napa. I had a wonderful steak and shrimp scampi there ($9.99) and a rib-eye steak the next day. (The Peppermill would be a close second, but it's not really on the downtown strip).

3. I discovered a new drink, the "Brandy Separator." I don't usually drink at all--I order virgin pina coladas and mineral water with lime when gambling--but when I saw this milky concoction, I had to try it. Absolutely yummy. Otherwise known as "Gorilla Milk," it's 1 1/4 parts brandy, 3/4 part Kahlúa liqueur, and 3/4 part heavy cream.

4. The first two rounds of 2009's March Madness were fantastic. At one point, two games were in OT, and then one of them went to double OT. That, my friends, is why you want to be in Nevada during March Madness. You can watch all the games on the multiple casino screens instead of relying on CBS to switch you to a particular game.

One complaint? I hated the refereeing. Some calls were atrocious. Not to take anything away from Siena, but one foul call against an Ohio State player during the last twenty seconds might have cost Ohio State the game. (The player never touched his man.)

Best coached team? Utah State. Every single play was perfectly executed. If their two best players hadn't fouled out at the last minute, they would have won. (See comment about refereeing above.)

Softest team? Wake Forest, i.e. this year's bracket buster. Wake Forest had no defense whatsoever. They could shoot well, but couldn't guard anyone. Wake hasn't produced a Final Four team in several decades, despite counting Tim Duncan and Chris Paul as alumni.

Biggest heart? University of Northern Iowa. After barely making it to the dance (they had to mount a miraculous comeback in an OT conference game to get an invite), they pushed Purdue to the limit. If some calls had gone UNI's way, we'd be looking at a potential Cinderella.

UNI also has the player with the coolest name: Ali Farokhmanesh.

MVP so far? UNC's Ty Lawson. Without him, UNC would be at home right now, watching the games on television. At one point, he was the only UNC player who scored in a four minute time span, which stopped the other team's run.

5. Best Reno sportsbook? Club Cal Neva (not to be confused with Tahoe's CalNeva). Club Cal Neva, during March Madness, had everything a guy and his buddies would want. Two girls in skimpy outfits offering jello shots; huge nachos for five bucks; multiple pitchers of beer everywhere; three rooms of television screens and plenty of seating; and drawings for sports memorabilia. If it wasn't March Madness, though, I'd probably go to Harrah's. They have a classy joint, and it shows.

Showing posts with label Reno. Show all posts

Showing posts with label Reno. Show all posts

Monday, March 23, 2009

Tuesday, June 24, 2008

Reno Automobile Museum, Part 2

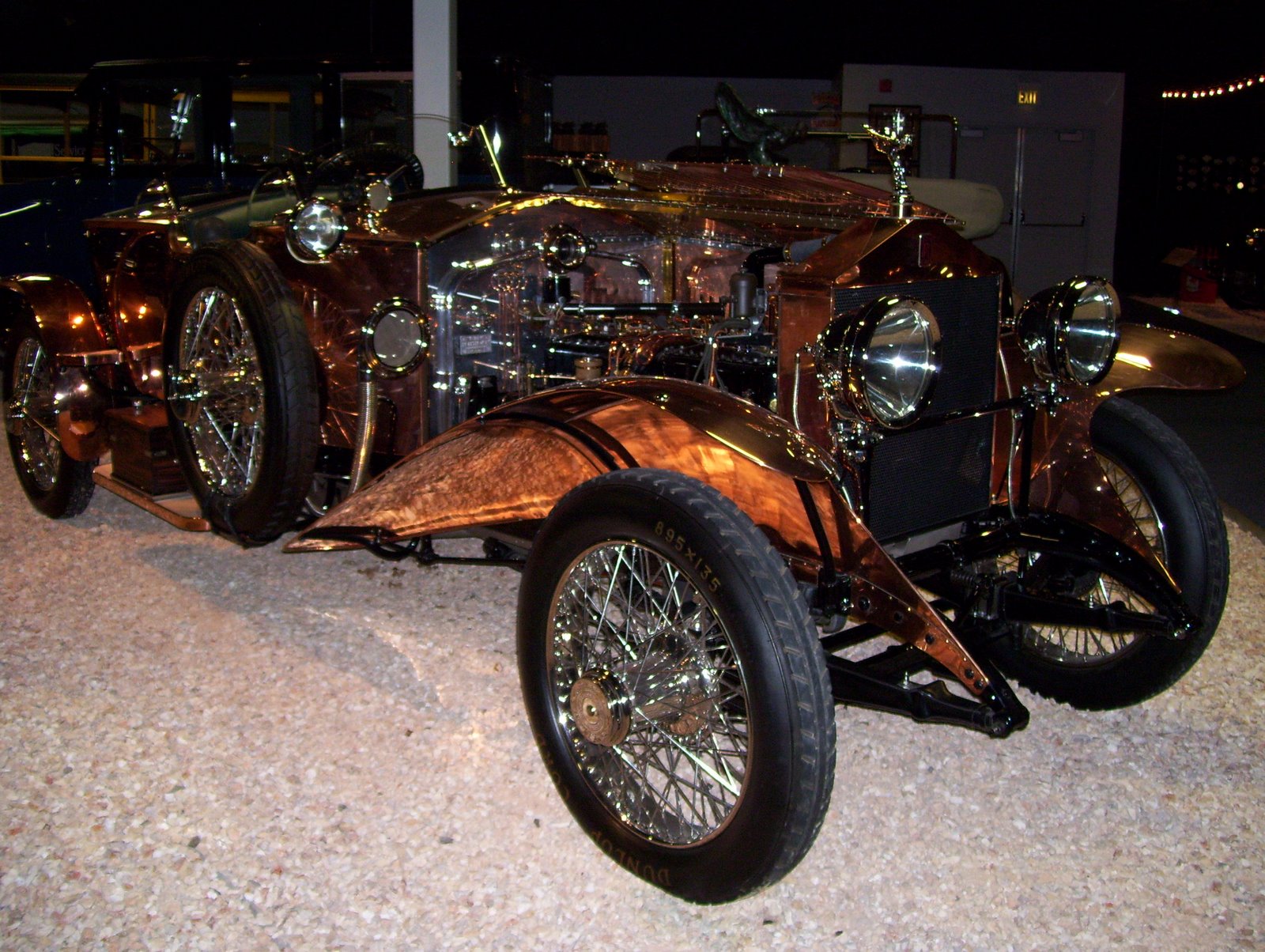

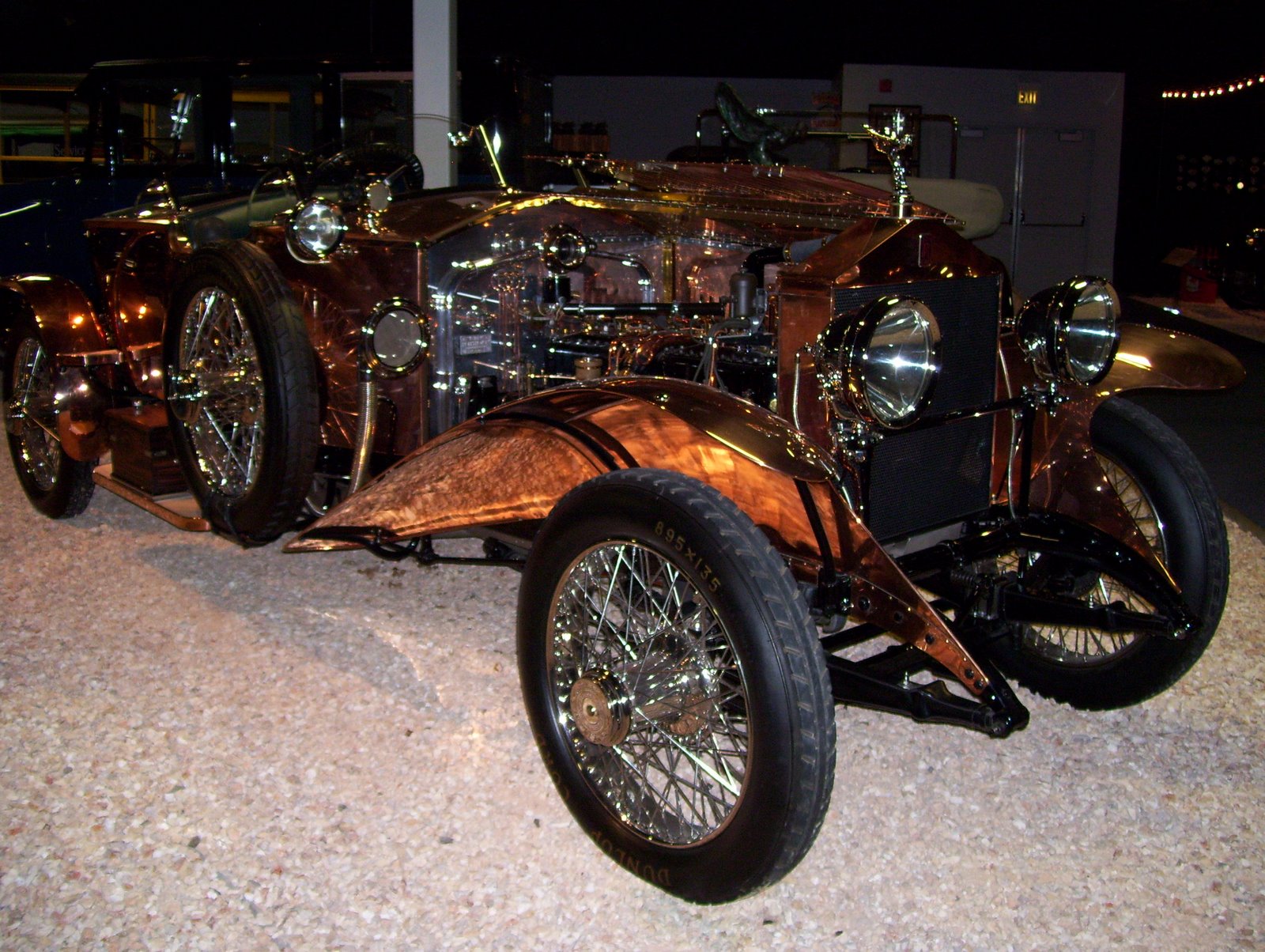

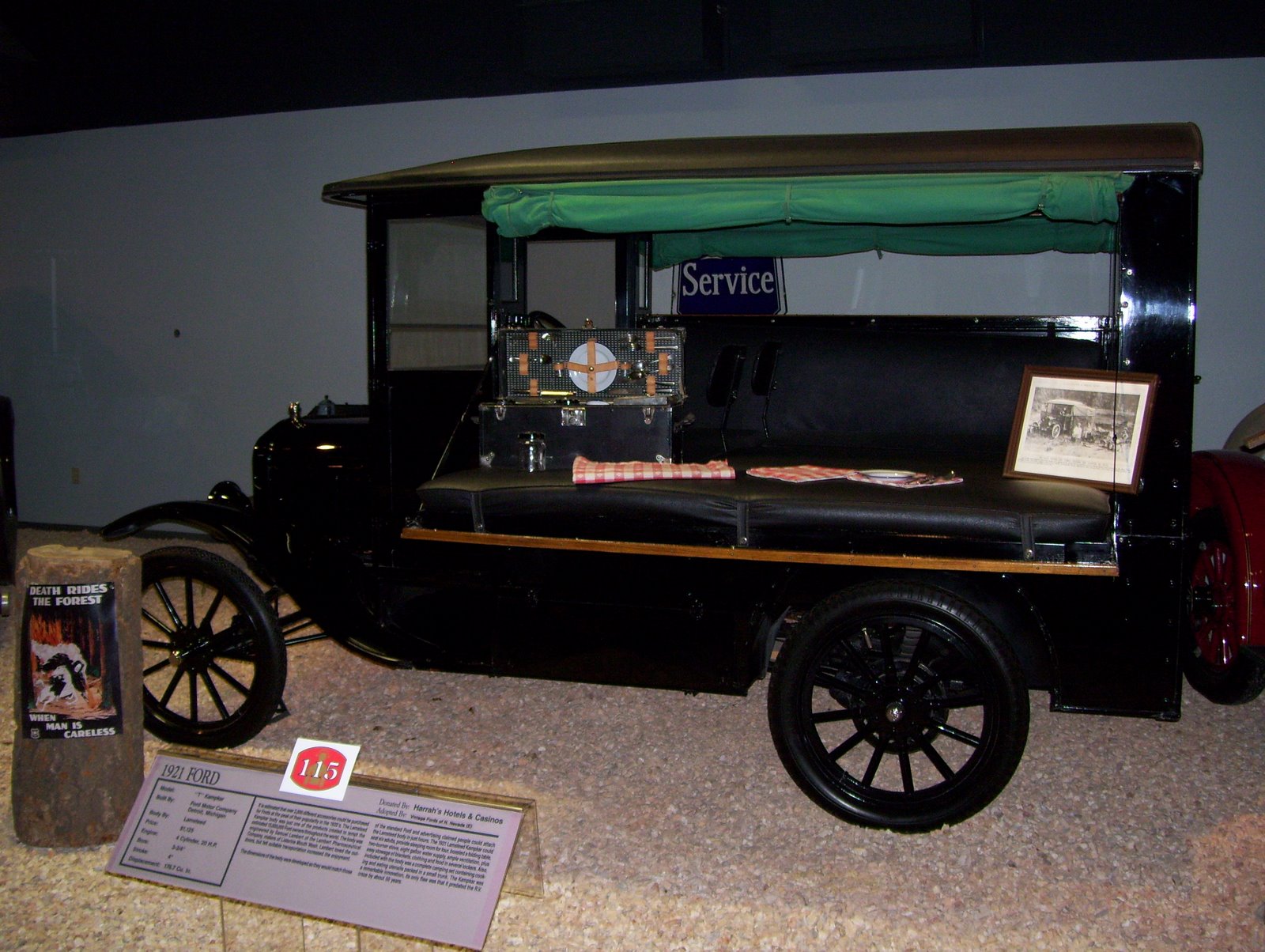

The cars above are just beautiful. Chrysler and Mercedes seemed to have the best designs. The Ford Edsel didn't look that bad--certainly not bad enough to be associated with failure. One advertising campaign was especially interesting--to demonstrate the toughness of a car, a company drove it off a cliff, and even after it bounced several times on rocks, it was still drivable. The older cars all looked heavier and larger than modern cars.

What stuck out the most was the car companies' willingness to experiment with designs and engineering (I saw a V-16 engine). Today, I like to say, without pleasure, that Ford and GM are slowly going bankrupt. GM is probably worth nothing without GMAC, its car loan unit. In fact, GM is probably closer to a bank than a car company. Meanwhile, Toyota innovates with hybrids and other models and does a better job of managing production and employee costs. It's sad to see the state of American car companies today and compare them with how robust they were back in the day. Part of me thinks that Kirk Kerkorian isn't buying Ford shares because he thinks there's an imminent turnaround--he's buying a large minority stake out of pure nostalgia.

Reno: National Automobile Museum, Part 1

The original R.V. (above)

The original R.V. (above)

Reno, Nevada, has lots to see and do. You can walk along Truckee River, relax at the Siena Casino spa, grab a classic grilled cheese sandwich off the main drag at the Peppermill, or just hit the slots at the Silver Legacy. You can also see some very old cars, and gain an insight into why car companies today aren't doing very well. In the old days, cars looked better, and American car companies were not afraid to innovate. Here is the link to the Museum:

http://www.automuseum.org

Saturday, June 21, 2008

Random Thoughts: Coffee and Tips

I had an interesting week. I stayed up late writing motions on a case where a public company is suing some ex-employees. The company is "pink-listed," or traded OTC (over the counter), at three cents a share. The company claims that my clients took their trade secrets. California case law requires "trade secrets" to have independent economic value, and this fabless semiconductor company's IC chips appear antiquated. (They have plenty of money to pay lawyers rather than R&D, apparently.) One line in my brief compared their product to the Gutenberg Press and how it couldn't be a "trade secret," even if a company makes its employees sign an agreement promising not to disclose the Gutenberg Press. The other side had no response to that line in their reply brief. As scintillating as all this might sound, the lawsuit is one example of how the big guys can crush or bankrupt small guys because it's usually more cost-effective for individuals to settle even frivolous cases than to pay for all the motions and depositions that come with any case (only 5 to 10% of civil cases actually get to trial, at least in Santa Clara County). In this case, my clients have decided to fight the good fight...and I guess I'll see how much debt I have to write off this year. Anyway, we'll get back to how my case is relevant to the economy.

First, I discovered this great foot massage place in San Jose, along Story Road (Little Vietnam/Saigon area). I talked with the owner, and we discussed how different cities deal with massage places. The vice squad of the local PD always vets these businesses--I represented some acupunture places before, so I am somewhat familiar with the licensing process. This San Jose owner has a great operation. He partnered with an educated Chinese immigrant who's been in California for many years. I am guessing she's the hard worker and connections, and he's the capital (he was perusing some bylaws as we spoke). They hire grads from massage schools in S.F. and L.A., probably pay them minimum wage, and the workers get to keep their tips. All of the workers are professional and appear to be Chinese immigrants. Customers are around each other in a relaxing, open area. Massages are only 20 dollars for an hour, an incredible bargain (massages are usually $40 to $60 an hour here, but those massages allow full body contact).

The massuers and massueses rely on tips in this business structure. After my massage, I gave my massuese a 4 dollar tip. I don't usually carry cash and use my credit cards to rack up points (paying off the balance each month). Realizing a 4 dollar tip was not enough, I asked my friend to provide me with two more dollars, thinking a 30% tip was sufficient. But in between receiving the additional dollars and giving it to my masseuese, I saw that she was clearly upset over receiving just a four dollars (20%) tip. When she received the 6 dollars, she appeared to be fine, or at least not insulted. Two thoughts came to mind:

1. There might be some relationship between how much it costs to buy one cup of coffee and tips. Coffee is ubiqitous and an everyday product. Everyone, rich, poor and even homeless, expects to be able to buy it. Pre-Starbucks, a cup of joe cost about a buck. In those days, a 2 dollar tip when the underlying service cost 20 dollars or less (e.g., bellhops, a few drinks) was sufficient. Now, even when the underlying cost for a service is 20 dollars or less, people expect more than just a few dollars as a tip. Psychologically, times have changed. A reasonable minimum tip might be calculated by how much it costs to buy two cups of coffee (in this case, around six dollars). Coffee prices might be a good indicator of inflation.

2. There's a greater lesson here than just how much to tip. A service economy relies on workers getting adequate tips, which shifts salary costs from businesses to customers. I did a service this week, too. I didn't get paid a tip, but I got paid $190/hr (a discounted rate, and I "no-charged" several hours also). The American economy has catapulted certain service professions from tip status into non-tip status. The non-tip jobs are usually the better ones, because the lack of tip means that the full price of the service is included, and the price is less elastic due to the greater bargaining power of the seller. I had to wonder, as I received my massage--who was contributing more to the economy and wellness? Me, with my motions and oppositions in a frivolous case filed by a three-cents-a-share company, or the masseuse?

I came to the conclusion that American society has arbitrarily vaulted my job into the non-tip column because theoretically, my job requires the use of other positions--paralegal, court clerk, judge, process server, and even a law school professor. The masseuse, while offering a more benign skill, gets paid less in the American economy because her job does not create other jobs. That appears to be the benchmark for getting paid in a capitalist system--make sure your job theoretically requires several other jobs, or is interlinked with a diverse set of jobs.

In reality, my job, at least this week, was less important or useful than the masseuse's. That's the problem with having a service-based economy--it arbitrarily makes certain positions better than others not based on output, but on expected total consumption. Other countries appear to be positioning their economies on output, i.e. paying persons who produce things more money. (Neither the masseuse nor I produce anything in the classical sense.) So in China, the jobs go to people who produce clothing, shoes, motorcycles, etc. People can make a living producing things. In India, the jobs go to people who produce generic drugs, steel, and computer products. Of course, all countries have a service and manufacturing sector, but until recently, most service-based jobs paid similarly, regardless of status. Doctors in Russia many years ago did not make much money. Lawyers certainly don't make as much money anywhere else in the world as they can in America. In Singapore, I interned in a firm's corporate legal division--almost all the lawyers in that division were women making about 45,000 U.S. annually. Looking at the American economy in this way, it appears to be based on pure air, just like our money post-Bretton Woods. Meanwhile, other countries are basing their service jobs on selling products to Americans. I don't have the time now or the mental energy to think these ideas through, but there is something dangerous lurking in the shadows (and no, I did not deliberately try to make that sound as ambiguous as possible).

I am off to Reno in eight hours for a short three day trip. I got a great deal on Southwest Airlines. The key to getting their cheaper internet fares seems to be buying a flight at least two weeks in advance. Speaking of Reno, there are two public companies in Reno that might be decent investments: 1) IGT, in which I own shares; and 2) SRP, or Sierra Pacific Resources.

SRP sells electricity and also natural gas. Once I get more funds available in my retirement accounts, I will look more closely at SRP and its dividend.

IGT sells gaming systems, better known as slot machines or electronic games, to casinos and Indian reservations. It's got a wide moat. No one is going to risk going with a newer, cheaper competitor in this area.

Due to my trip, I won't be posting anything new until at least June 24, 2008. I will update readers on the NVDIA shareholder meeting when I return. Good night, and wish me luck.

First, I discovered this great foot massage place in San Jose, along Story Road (Little Vietnam/Saigon area). I talked with the owner, and we discussed how different cities deal with massage places. The vice squad of the local PD always vets these businesses--I represented some acupunture places before, so I am somewhat familiar with the licensing process. This San Jose owner has a great operation. He partnered with an educated Chinese immigrant who's been in California for many years. I am guessing she's the hard worker and connections, and he's the capital (he was perusing some bylaws as we spoke). They hire grads from massage schools in S.F. and L.A., probably pay them minimum wage, and the workers get to keep their tips. All of the workers are professional and appear to be Chinese immigrants. Customers are around each other in a relaxing, open area. Massages are only 20 dollars for an hour, an incredible bargain (massages are usually $40 to $60 an hour here, but those massages allow full body contact).

The massuers and massueses rely on tips in this business structure. After my massage, I gave my massuese a 4 dollar tip. I don't usually carry cash and use my credit cards to rack up points (paying off the balance each month). Realizing a 4 dollar tip was not enough, I asked my friend to provide me with two more dollars, thinking a 30% tip was sufficient. But in between receiving the additional dollars and giving it to my masseuese, I saw that she was clearly upset over receiving just a four dollars (20%) tip. When she received the 6 dollars, she appeared to be fine, or at least not insulted. Two thoughts came to mind:

1. There might be some relationship between how much it costs to buy one cup of coffee and tips. Coffee is ubiqitous and an everyday product. Everyone, rich, poor and even homeless, expects to be able to buy it. Pre-Starbucks, a cup of joe cost about a buck. In those days, a 2 dollar tip when the underlying service cost 20 dollars or less (e.g., bellhops, a few drinks) was sufficient. Now, even when the underlying cost for a service is 20 dollars or less, people expect more than just a few dollars as a tip. Psychologically, times have changed. A reasonable minimum tip might be calculated by how much it costs to buy two cups of coffee (in this case, around six dollars). Coffee prices might be a good indicator of inflation.

2. There's a greater lesson here than just how much to tip. A service economy relies on workers getting adequate tips, which shifts salary costs from businesses to customers. I did a service this week, too. I didn't get paid a tip, but I got paid $190/hr (a discounted rate, and I "no-charged" several hours also). The American economy has catapulted certain service professions from tip status into non-tip status. The non-tip jobs are usually the better ones, because the lack of tip means that the full price of the service is included, and the price is less elastic due to the greater bargaining power of the seller. I had to wonder, as I received my massage--who was contributing more to the economy and wellness? Me, with my motions and oppositions in a frivolous case filed by a three-cents-a-share company, or the masseuse?

I came to the conclusion that American society has arbitrarily vaulted my job into the non-tip column because theoretically, my job requires the use of other positions--paralegal, court clerk, judge, process server, and even a law school professor. The masseuse, while offering a more benign skill, gets paid less in the American economy because her job does not create other jobs. That appears to be the benchmark for getting paid in a capitalist system--make sure your job theoretically requires several other jobs, or is interlinked with a diverse set of jobs.

In reality, my job, at least this week, was less important or useful than the masseuse's. That's the problem with having a service-based economy--it arbitrarily makes certain positions better than others not based on output, but on expected total consumption. Other countries appear to be positioning their economies on output, i.e. paying persons who produce things more money. (Neither the masseuse nor I produce anything in the classical sense.) So in China, the jobs go to people who produce clothing, shoes, motorcycles, etc. People can make a living producing things. In India, the jobs go to people who produce generic drugs, steel, and computer products. Of course, all countries have a service and manufacturing sector, but until recently, most service-based jobs paid similarly, regardless of status. Doctors in Russia many years ago did not make much money. Lawyers certainly don't make as much money anywhere else in the world as they can in America. In Singapore, I interned in a firm's corporate legal division--almost all the lawyers in that division were women making about 45,000 U.S. annually. Looking at the American economy in this way, it appears to be based on pure air, just like our money post-Bretton Woods. Meanwhile, other countries are basing their service jobs on selling products to Americans. I don't have the time now or the mental energy to think these ideas through, but there is something dangerous lurking in the shadows (and no, I did not deliberately try to make that sound as ambiguous as possible).

I am off to Reno in eight hours for a short three day trip. I got a great deal on Southwest Airlines. The key to getting their cheaper internet fares seems to be buying a flight at least two weeks in advance. Speaking of Reno, there are two public companies in Reno that might be decent investments: 1) IGT, in which I own shares; and 2) SRP, or Sierra Pacific Resources.

SRP sells electricity and also natural gas. Once I get more funds available in my retirement accounts, I will look more closely at SRP and its dividend.

IGT sells gaming systems, better known as slot machines or electronic games, to casinos and Indian reservations. It's got a wide moat. No one is going to risk going with a newer, cheaper competitor in this area.

Due to my trip, I won't be posting anything new until at least June 24, 2008. I will update readers on the NVDIA shareholder meeting when I return. Good night, and wish me luck.

Subscribe to:

Posts (Atom)