Warren Buffett's Berkshire Hathaway Inc. held its annual meeting today. For all the talk of frosty relations between China and USA, the American billionaire's longest ancillary presentations were China-related: "U.S.-China forum" and "U.S.-China Investor Forum." China-based BYD and Oglivy Global China also made appearances, with Oglivy indicating "rule of law" and "capital markets" were the major reasons USA businesses continued to succeed.

Capital being mobile and American lawyers being no pillars of honesty or efficiency, one wonders if Chinese executives have already co-opted the best elements of America's corporate playbook. After all, it was China, not USA, that most recently issued an antitrust ruling against one its largest technology companies, and China that received more capital inflows than USA during COVID19 because of its deft (and draconian) handling of the pandemic.

What was China's reaction to receiving "hot money" after its world-leading post-pandemic recovery? It increased its funds' limits on overseas investments, essentially transferring "paper" inflation risk to the United States and the EU. (If it sounds like Communist Chinese regulators are one step ahead of capitalist Americans, it may be because China has studied Hong Kong and Singapore.)Twenty years after September 11, 2001, the evidence is clear and convincing: given the size and influence of the informal economy, America's single-minded focus on terrorism guaranteed American isolationism and thus China's rise. More specifically, when American regulators demanded full compliance with financial regulations designed to catch criminals, capital reaction was swift: capital, being mobile, left to more neutral, business-friendly locations. In seeking status as the world's indispensable currency, the USD failed to acknowledge a conflict: it required legal monogamy and obedience from its partners at the same time it actively played the field. Cheating was inevitable.

Consider sanctions: they work only if the party being blocked needs something from the sanctioning body. In other words, sanctions fail in a multi-polar world where parties can obtain goods and services from multiple sources at comparable prices. Where such goods and services are available at lower prices than sanction-happy competitors, the result is foretold: China's economic rise from 2001 to 2021 and beyond. Similar to America's gun laws, long-arm statutes pursuing international enforcement have produced not compliance but more creative sellers, leaving the already law-abiding as the only persons affected. In this context, USA's extrajudicial actions, such as arresting a Huawei executive (via Canada), make sense, as does the rise of non-traditional banking such as cryptocurrency.

"Extrajudicial" is exactly what it looks like: outside the law. When lawyers fail to create workable alternatives to international competitors, whether formal or informal, they create disrespect for their country's laws while increasing opponents' opportunities. As of today, the effect is both domestic and international: after at least sixty years of failure, many American local governments are no longer interested in following federal policies on drugs or sex unless paid handsomely in federal grants.

A geographically-isolated democracy in which lawyers and politicians cannot prove their legal model is ideal creates a vacuum that will be filled by multinational corporations, international mafia, and one-party governments. Why one-party governments? Because a world lacking idealistic, moral and wise lawyers favors the executive branch and thus non-democratic political systems. China's most significant 21st century contribution may not be replacing the United States but establishing a "post-political" world. Do we really want the most accessible cultural values to be determined by multinational banks, behemoth investors, and centralized governments? As long as more people are likelier to listen to Buffett than Biden, we'll find out.

© Matthew Rafat (May 2021)

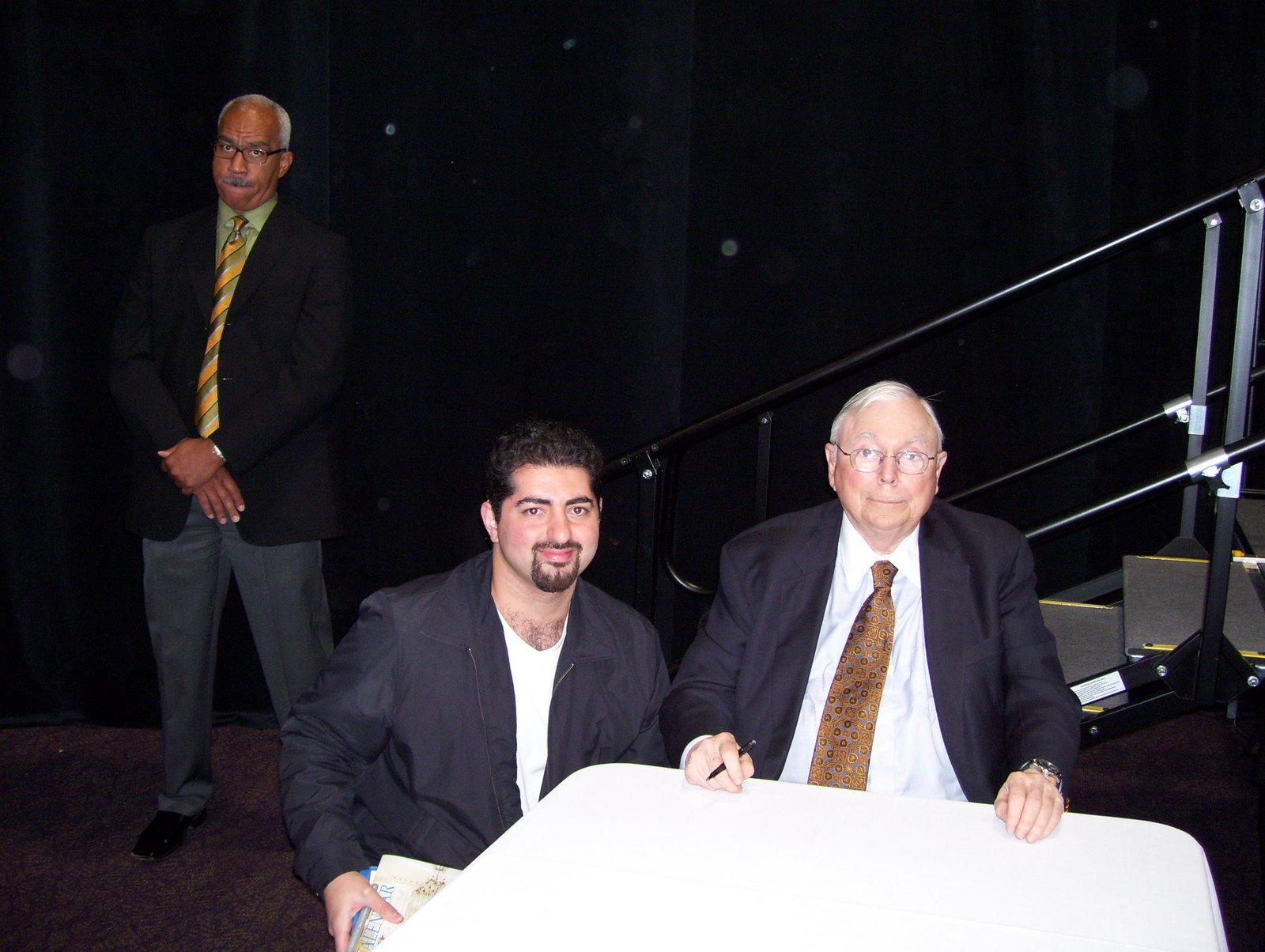

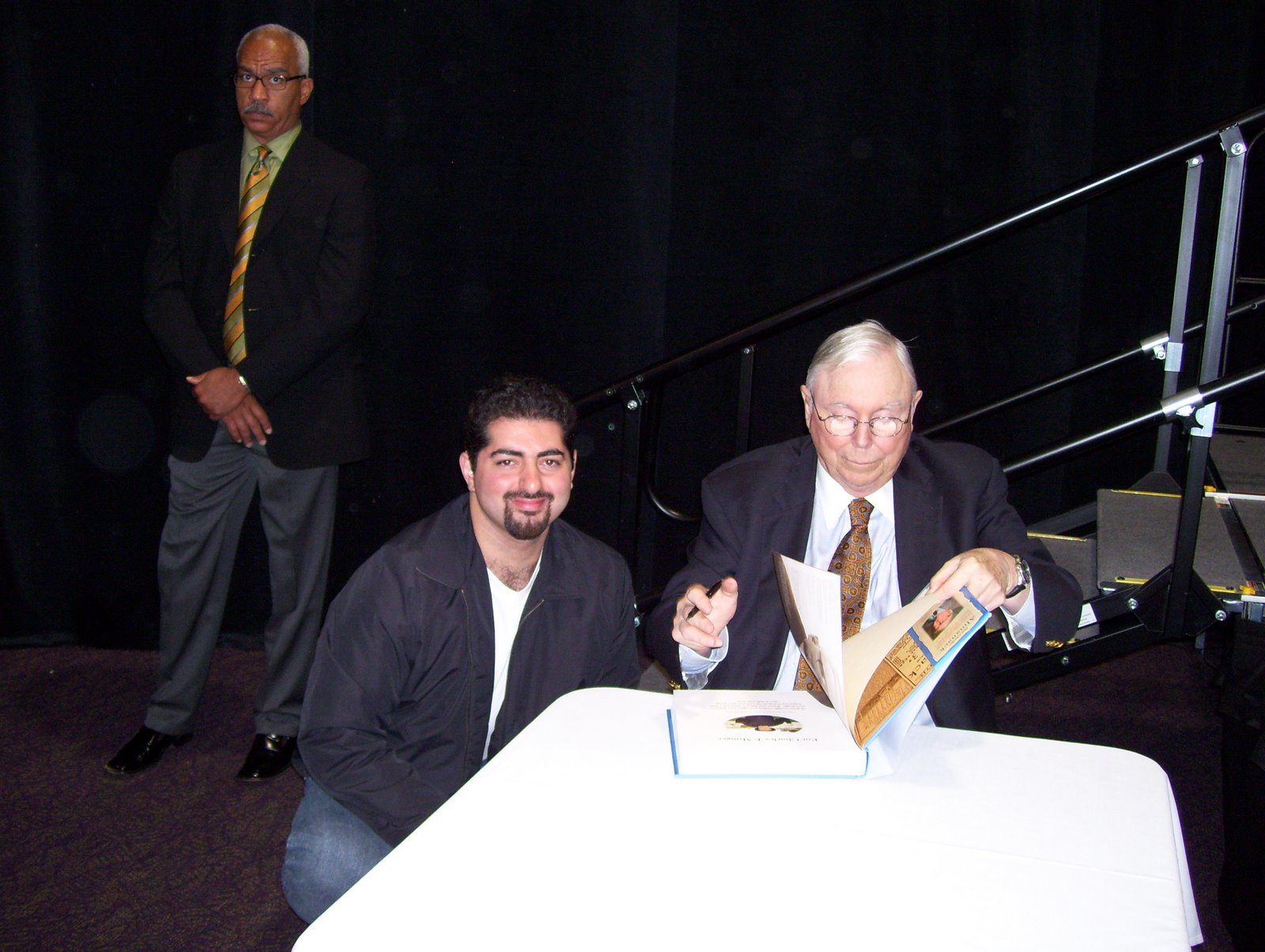

"The Chinese government will allow businesses to flourish... [after studying Singapore] they changed Communism, and now we have Communism with Chinese characteristics." -- Charlie Munger (2021)